Key Takeaways

- Private health insurance may cover tummy tuck (abdominoplasty) costs if the procedure is deemed medically necessary, unlike purely cosmetic surgeries which are not covered.

- There are different tiers of private health insurance in Australia (Basic, Bronze, Silver, Gold), with Gold policies generally offering the best coverage for tummy tuck surgery.

- Medicare Australia covers certain weight loss surgeries and may provide rebates for tummy tuck surgery if it meets specific medical criteria outlined in the Medicare Benefits Schedule (MBS).

- It is crucial to maintain ideal weight for at least 6 months before undergoing a tummy tuck surgery for optimal results.

- When choosing private health insurance for tummy tuck surgery, it's essential to compare policies, check coverage details, and be aware of waiting periods for pre-existing conditions.

Are you considering private health insurance for tummy tuck (abdominoplasty)? If so, you’re not alone. Millions of Australians are searching online for the option of private health insurance to cover the costs associated with body smoothing after massive weight loss or pregnancy.

When considering weight loss surgery, Medicare Australia could be the right option. However, if you are searching for more comprehensive coverage of a tummy tuck (abdominoplasty) or body smoothing procedure, private health insurance may be worth considering.

In this article, we’ll take a look at what private health insurance covers when it comes to tummy tuck surgery (abdominoplasty) and how you can get the most out of your policy.

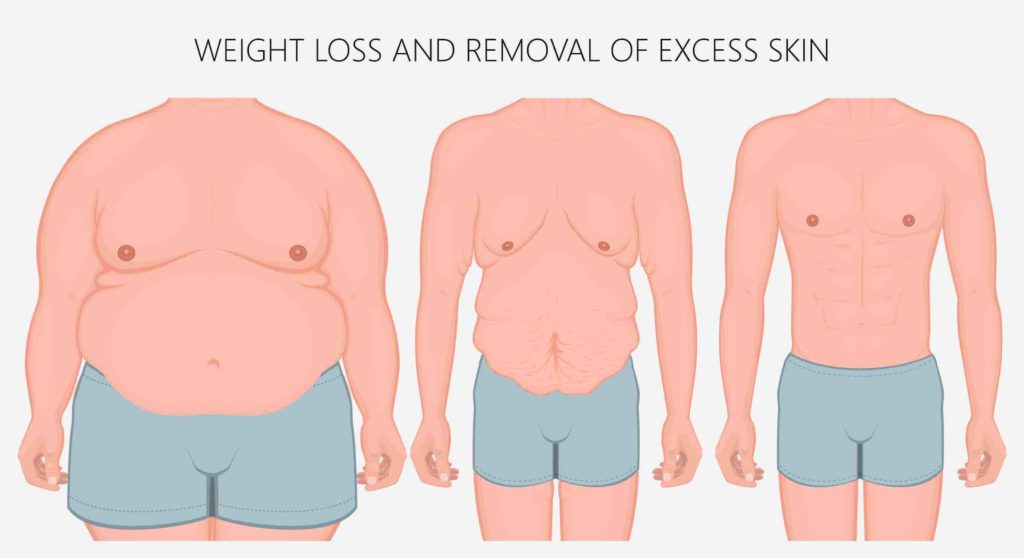

Weight Loss Surgery vs Excess Skin Removal Surgery

While often confused, there is a big difference between weight loss surgery and excess skin removal surgery:

- Weight loss surgery is a procedure performed to assist you in losing weight, such as gastric banding and gastric bypass surgery.

- Tummy tuck (abdominoplasty) surgery provides a way to remove loose skin on the lower stomach after losing significant amounts of weight.

Please note that a tummy tuck (abdominoplasty) itself is not a weight loss procedure, yet it is important that you lose weight before a tummy tuck (abdominoplasty) surgery. To get the best results from your tummy tuck or panniculectomy, you’ll need to maintain your ideal weight for at least 6 months before undergoing body smoothing surgery.

Overview of Private Health Insurance for Tummy Tuck (Abdominoplasty)

Private health insurance can cover a variety of treatments and procedures, depending on the private health fund’s individual policy.

If you require the procedure for medical reasons, such as removing loose skin due to major weight loss, private health insurance might cover some of your expenses.

On the other hand, if you request surgery purely for cosmetic reasons, then unfortunately, none of the costs will be covered by your insurer. Health insurance for cosmetic surgery is not available in Australia, and there are no current policies of private health insurance that cover cosmetic surgery.

What Does Private Health Insurance Cover for Tummy Tuck (Abdominoplasty) Procedures?

It’s important to understand what your private health insurer covers when it comes to tummy tuck surgery (Abdominoplasty), panniculectomy, or other excess skin removal surgeries. Generally speaking, private health insurers cover some or all of the following:

- The cost of hospital accommodation

- Anesthesia fees

- The cost of medications

- Any pre-operative and post-operative tests or consultations

Please note, these inclusions typically require a comprehensive or “top cover” policy.

When comparing private health insurance policies, make sure to read the fine print and ask your private health insurer any questions you may have about coverage for tummy tuck (abdominoplasty) procedures.

Types of Private Health Insurance Policies Available for Tummy Tuck (Abdominoplasty) Surgery

When you are considering private health insurance for tummy tuck surgery (Abdominoplasty), you’ll need to take a look at the different types of policies available.

In Australia, there are four tiers of private health insurance: Basic, bronze, silver, and gold.

- Gold covers a wide range of private hospital treatments with minimal out-of-pocket expenses.

- Silver policies offer coverage for private hospital treatment with a small gap payment.

- Bronze covers private hospital treatments but requires higher out-of-pocket payments, and

- The basic option generally provides limited private hospital coverage.

It’s important to note that private health insurance for tummy tucks (abdominoplasties) can vary from one insurer to the next. Generally, gold policies are most likely to cover the cost of tummy tuck (abdominoplasty) surgery if you have a medical need. Some silver and bronze plans may also provide coverage depending on your individual provider and policy.

The Relation Between Medicare and Private Health Insurance Coverage for Surgery

In Australia, the Medicare Benefits Schedule (the MBS) is a prerequisite for private health coverage. Your Private Health Insurance will assist with the cost of medical services if they fall under the guidelines of the MBS.

To reiterate, if you attract a Medicare item number for plastic surgery, your health insurance can assist with the cost (given it’s within your individual policy).

The biggest benefit of this is the reduction in the total out-of-pocket costs for your medically necessary procedure. Please also keep in mind that there will be remaining costs after private health insurance reimbursement, depending on the private health fund and type of coverage you have.

Weight Loss Surgery Covered by Medicare Australia

In Australia, bariatric surgery is covered by Medicare, and therefore, private health insurance for weight loss surgery is available. Medicare item numbers 31569 to 31581 and item number 20791 provide for surgical treatment of clinically severe obesity and the accompanying anesthesia service (or similar). Weight loss surgeries covered by Medicare include:

- Laparoscopic sleeve gastrectomy (gastric sleeve) – MBS item number 31575

- Laparoscopic gastric bypass – MBS item number 31572

Excess Skin & Excess Fat Removal Procedures Covered by Medicare Australia

If your excess skin or excess fat removal procedure is deemed medically necessary, then you may be eligible for private health coverage. This includes procedures such as:

- Tummy tuck (Abdominoplasty) and/or panniculectomy (removal of hanging skin and fat in the lower abdomen) – MBS item number 30177

- Lower body lift (lift of the lower body or buttocks) – MBS item number 30165

- Thigh lift and arm lift surgery – MBS item number 30171

For a breakdown of the criteria needed to qualify for private health insurance coverage, please see our page on excess skin removal medicare.

What is The Best Health Insurance for Weight Loss Surgery Australia?

The policy you choose regarding health insurance for weight loss surgery is dependent on your specific needs. Private health insurance for weight loss surgery, private hospital coverage, and affordability can vary from one insurer to the next. You can compare policies for obesity and health insurance on Finder.com.au.

What to Consider When Choosing Private Health Insurance for a Tummy Tuck (Abdominoplasty)?

When considering private health insurance for a tummy tuck (abdominoplasty), it’s a good idea to compare available policies from different private health funds. As mentioned before, the cost of private health insurance for tummy tuck (abdominoplasty) surgery can vary depending on several factors, including individual providers and policies.

Always ensure that your private health insurance covers the procedure you are looking to have done. Next, check that they provide adequate cover for items such as private hospital fees, anaesthetist fees, and surgeon’s fees. Make sure to read through your policy carefully before committing to it so that you can be sure of exactly what is covered.

Waiting Period for Weight Loss Surgery and/or Tummy Tuck (Abdominoplasty) Surgery

Once you have narrowed down some options for private health insurance, you will need to consider the waiting period for surgery. A waiting period is an initial period of health insurance membership during which no benefit is payable for certain procedures or services.

The Private Health Insurance Act 2007 sets out the maximum hospital waiting periods that health insurers can apply. This outlines that private health insurers are limited to a maximum of 12 months waiting period for pre-existing conditions (and two months for all other services).

Bupa Waiting Period for Weight Loss Surgery

As an example, the Bupa weight loss surgery waiting period is 12 months. This is because obesity is considered a pre-existing condition. It’s safe to assume that most health insurance providers adhere to the same standards.

Excess Skin Removal Surgery Cost Australia

With the help of Private Health Insurance, excess skin removal surgery can become much more accessible and affordable. Knowing how private health insurance works for tummy tuck surgery (abdominoplasty) and other body firming procedures will help you make the best decision for your own personal situation.

Please note, that even if you meet the qualifications for coverage, you will still need to pay your surgeon’s fee. This varies based on both the surgery that needs to be performed and the qualifications and expertise of your chosen surgeon. To receive a personalised cost estimate, please contact our team through our secure and confidential contact form.

FAQs

What is the Best Health Insurance for Weight Loss Surgery?

The best health insurance for weight loss surgery is dependent on your individual needs. It’s recommended that you compare multiple private health funds to find one that fits your budget and offers adequate coverage for the item numbers listed above.

Is Private Health Insurance for Tummy Tuck (Abdominoplasty) Necessary?

It is not necessary to have health insurance to undergo Tummy Tuck (Abdominoplasty) surgery. However, it can help to mitigate hospital and anaesthetic costs.

Which Health Insurance Covers Cosmetic Surgery?

There is no cosmetic surgery insurance or health insurance that covers cosmetic surgery offered in Australia. Benefits are only payable for medically necessary procedures such as bariatric surgery, breast lift surgery, breast reduction surgery, and excess skin removal surgery.

Does Bupa Cover Cosmetic Surgery?

Bupa health insurance is available in Australia, however, Bupa cosmetic surgery coverage does not exist. Medicare (the MBS) and private health insurance only covers medically necessary procedures.

Is a Tummy Tuck (Abdominoplasty) Covered by Medicare in Australia?

Yes, however, a tummy tuck (Abdominoplasty) will only attract a Medicare rebate if it is deemed medically necessary. For more information on the medical criteria needed to qualify, please see Will Medicare Cover My Tummy Tuck (Abdominoplasty) in Queensland?

Next Steps

For more information about private health insurance for Tummy Tuck (Abdominoplasty), please contact our team or book a consultation with Specialist Plastic Surgeon, Dr Mark Doyle.

About Dr Mark Doyle FRACS (Plas) – Queensland Plastic Surgeon

Servicing patients in Gold Coast, Brisbane, Sunshine Coast, Cairns and New South Wales NSW – Northern Rivers, Byron Bay, Ballina, Lismore and more.

Dr Mark Doyle is a fully qualified Specialist Plastic Surgeon with over 30 years of experience performing breast, body, face and nose surgery. He has completed all required training and only carries out approved surgical practices. There are NO undertrained doctors or cosmetic doctors acting as surgeons at Gold Coast Plastic Surgery.